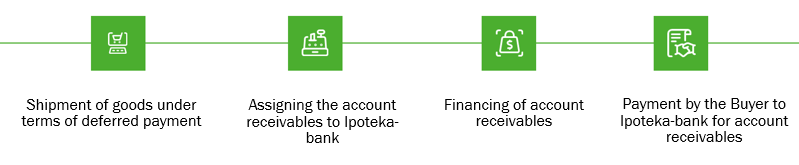

Factoring is a comprehensive financial service for suppliers that includes financing based on the assignment of receivables, monitoring and control of payments, collection of payments from buyers, and protection against non-payment risk in the case of non-recourse factoring.

Factoring for Suppliers

Financing of accounts receivable

- 90 days of deferral period

- With and without recourse

- Without collateral

- Without targeted use

- Financing on the day of goods shipment

- Up to 100% of the invoice

- Supplier and Buyer – residents of Uzbekistan

Don’t wait 30–90 days for the buyer to pay — get paid for your goods today.

Factoring for Buyers

Financing accounts payables

- Prolongation of deferral period

- Synchronization of procurement, production, and commercial cycles with financial flows

- Effective supply chain management and expansion of the supplier base

- Deferral period: till 90 days

- Grace period: 30 days

Get a payment deferral for raw materials, supplies, or goods, and Ipoteka Bank will make a 100% prepayment to your suppliers.