Loan for replenishing of working capital

Interest rate

27%

Term of loan

36

Currency

UZS

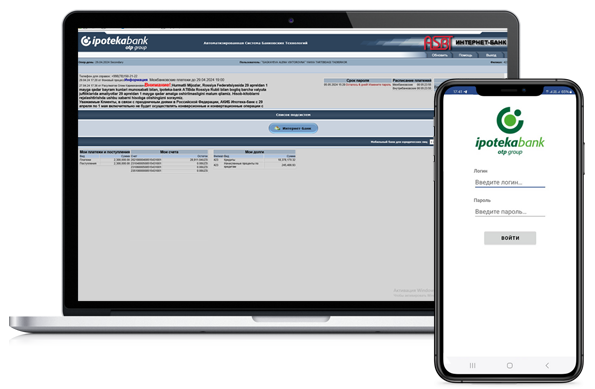

Internet/Mobile bank

Application for opening a loan

|

CREDIT PRODUCT PASSPORT FOR REPLENISHING WORKING CAPITAL |

|

|

Product category |

To replenish working capital |

|

Product type |

Loan |

|

Agro / non agro |

Non agro |

|

Business line (segment) |

Micro and Small Enterprises |

|

Client |

Legal entities and individual entrepreneurs |

|

Targeted clientele |

Existing and potential clients of the bank (micro and small enterprises and private entrepreneurs) |

|

Start up |

No |

|

Current account history at the Bank |

1) Existing to bank clients (ETBc) 2) New to bank clients (NTBc) |

|

Purpose of the loan |

For the purchase of goods (works, services) in order to replenish working capital and payment of wages |

|

Max. amount of the loan |

1) For legal entities - up to 1 250.0 mln. UZS (For wage loan - no more than two months' salary) 2) For private entrepreneurs - up to 650.0 mln. UZS Total liability of the client should not exceed these amounts |

|

Min. amount of t the loan |

1) For legal entities - 50,0 mln. UZS 2) For private entrepreneurs - 25,0 mln. UZS |

|

Possible currencies |

In national currency |

|

Interest rate (IR) (%) |

29% per annum |

|

Type of maturity |

Non revolving |

|

Max. Maturity |

Up to 36 months (45 days for wage payment) |

|

Accepted collaterals |

Real estate, vehicles |

|

Frequency of interest payments |

Monthly payment (Wage loans are paid at the end of the term) |

|

Type of disbursement |

1) By transferring money to the supplier's account. It is carried out on the condition of one-time or gradual transfer; 2) In cash only for the Bazar sector (List of the service centers allowed to disburse in cash should be in application defined by risk department) 3) Wage loan transferred to the main account of the client |

|

Grace period for capital repayment |

No grace period |

|

Method of reimbursement |

Annuity or differential method |

|

Frequency of capital repayment |

1) Monthly payment 2) Loans for salary payments are made at the end of the loan term |

|

Rule of prepayment |

Early repayment option available |

According to small business financing programm, Ipoteka-bank presents for your attention a wide range of loans for business.

Bank's product line allows to solve any tasks related to develop the business and ensuring its competitiveness.

When making a decision to grant a loan, Ipoteka-Bank is based on information about the real state of the business of a potential borrower. The main focus is on the development prospects of the business proposed for financing, rather than on formal indicators.

An individual approach to each customer allows Ipoteka Bank to offer loans to small businesses on the most favorable terms for customers. The interest rate for the use of credit funds is set based on the market conditions and the financial condition of the borrower. Interest is charged on the balance of the outstanding loan, which allows clients to avoid additional costs.

|

CREDIT PRODUCT PASSPORT FOR REPLENISHING WORKING CAPITAL |

|

|

Product category |

To replenish working capital |

|

Product type |

Loan |

|

Agro / non agro |

Non agro |

|

Business line (segment) |

Micro and Small Enterprises |

|

Client |

Legal entities and individual entrepreneurs |

|

Targeted clientele |

Existing and potential clients of the bank (micro and small enterprises and private entrepreneurs) |

|

Start up |

No |

|

Current account history at the Bank |

1) Existing to bank clients (ETBc) 2) New to bank clients (NTBc) |

|

Purpose of the loan |

For the purchase of goods (works, services) in order to replenish working capital and payment of wages |

|

Max. amount of the loan |

1) For legal entities - up to 1 250.0 mln. UZS (For wage loan - no more than two months' salary) 2) For private entrepreneurs - up to 650.0 mln. UZS Total liability of the client should not exceed these amounts |

|

Min. amount of t the loan |

1) For legal entities - 50,0 mln. UZS 2) For private entrepreneurs - 25,0 mln. UZS |

|

Possible currencies |

In national currency |

|

Interest rate (IR) (%) |

29% per annum |

|

Type of maturity |

Non revolving |

|

Max. Maturity |

Up to 36 months (45 days for wage payment) |

|

Accepted collaterals |

Real estate, vehicles |

|

Frequency of interest payments |

Monthly payment (Wage loans are paid at the end of the term) |

|

Type of disbursement |

1) By transferring money to the supplier's account. It is carried out on the condition of one-time or gradual transfer; 2) In cash only for the Bazar sector (List of the service centers allowed to disburse in cash should be in application defined by risk department) 3) Wage loan transferred to the main account of the client |

|

Grace period for capital repayment |

No grace period |

|

Method of reimbursement |

Annuity or differential method |

|

Frequency of capital repayment |

1) Monthly payment 2) Loans for salary payments are made at the end of the loan term |

|

Rule of prepayment |

Early repayment option available |

According to small business financing programm, Ipoteka-bank presents for your attention a wide range of loans for business.

Bank's product line allows to solve any tasks related to develop the business and ensuring its competitiveness.

When making a decision to grant a loan, Ipoteka-Bank is based on information about the real state of the business of a potential borrower. The main focus is on the development prospects of the business proposed for financing, rather than on formal indicators.

An individual approach to each customer allows Ipoteka Bank to offer loans to small businesses on the most favorable terms for customers. The interest rate for the use of credit funds is set based on the market conditions and the financial condition of the borrower. Interest is charged on the balance of the outstanding loan, which allows clients to avoid additional costs.

Calculation of loan

| Commercial bank name, official website, phone numbers | JSCMB "Ipoteka-bank", www.ipotekabank.uz Phone:(78) 150-11-22, Call-centr:1233 |

|---|---|

|

Loan amount (Enter the amount and calculate the total value of the loan) |

Calculation graph |

|

|---|---|

|

Loan period (in months)

(Insert the required month.) |

|

|

Loan percentage (in percent) (Enter the appropriate deposit percentage) |

|

| The total amount of interest in UZS |

0 |

| Total amount of loan |

0 |