As you know, operational risks - possible losses from inadequate or erroneous internal processes or systems, actions of employees or external events - have a great impact on the bank's activities and can lead to significant negative consequences. In the global banking practice, the management of operational risks is one of the key and paramount tasks.

In order to minimize the bank's losses from operational risks, ensure the stability and continuity of the business, risk coordinators have been appointed in all branches of JSCMB

Ipoteka-Bank, as well as in all divisions of the head office.

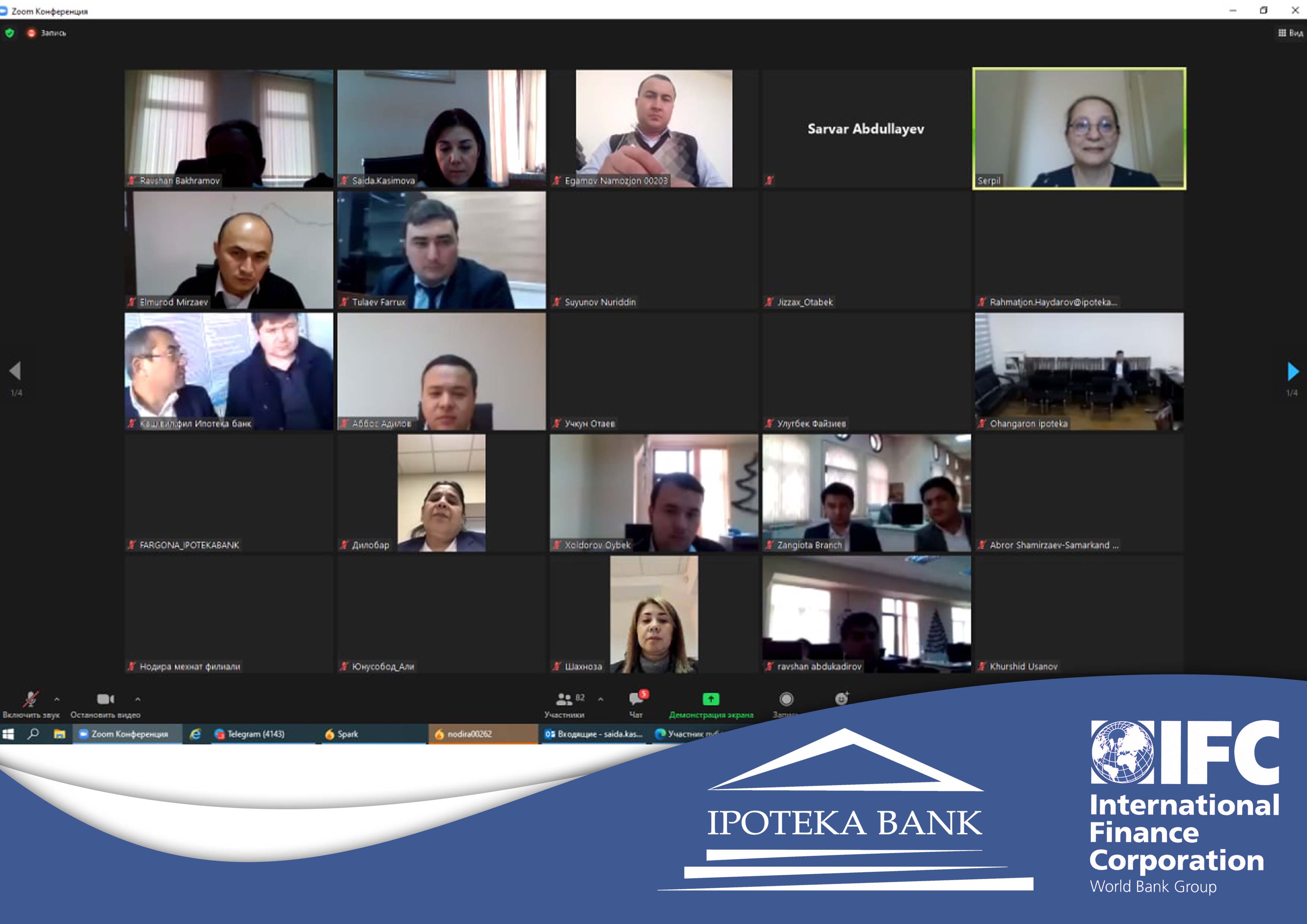

As part of the second phase of transformation and cooperation with the International Finance Corporation, a member of the World Bank Group, for all the risk coordinators of the head office and branches of the Ipoteka Bank system, on January 7, 2021, a zoom webinar was organized on the topic “Operational loss incidents”.

The leading expert of the IFC Serpil Ali Shah took part in the webinar. Risk coordinators were provided with a thematic presentation and detailed explanation on how to identify operational risks, calculate and report on incurred operational losses (OLI).

The webinar was conducted in an interactive mode in the form of questions and answers, special attention was paid to the reporting procedure “Losses from operational incidents” based on advanced knowledge and international experience in the field of operational risk management.

This webinar was held within the framework of measures to introduce the norms and requirements of the Operational Risk Management Policy of JSCMB Ipoteka-Bank into the activities of the bank and is aimed at creating a risk culture among bank employees, increasing their knowledge in the field of identifying and self-assessing operational risks in order to implement further measures to effectively manage operational risks.