Issues on Environmental and Social Risk Management in the Center of Attention of the Bank's Supervisory Board

Posted by: 5 october, 2021

In the modern world, environmental and social issues pose challenges on a global scale. That is why, in order to ensure long-term stability, sustainable development demands primary attention.

In this regard, ensuring sustainable development of society is one of the main goals of the corporate governance system. Banks, as one of the links in the corporate world, are also no exception. Moreover, banks play an important role in this area, financing projects aimed at sustainable development.

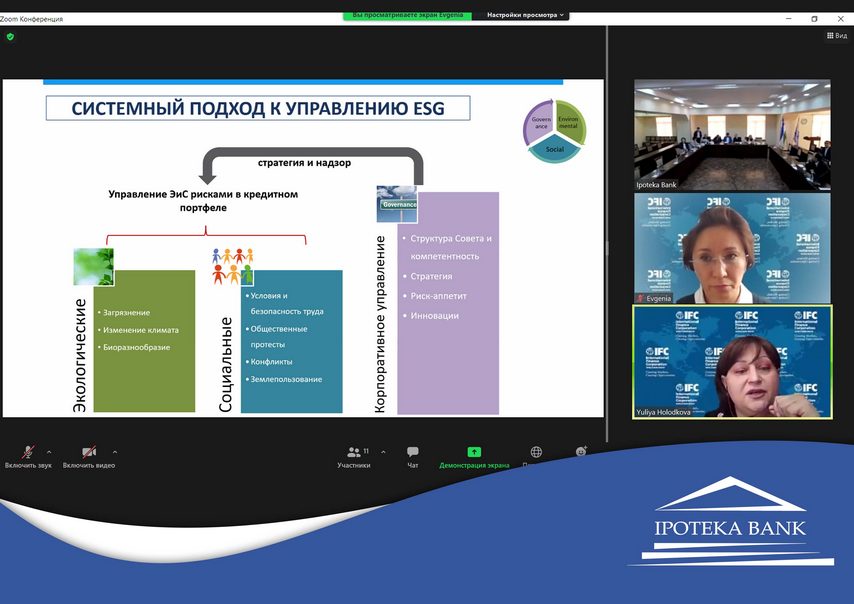

Thus, investors are increasingly realizing that corporate efficiency in relation to relevant environmental, social and governance (ESG) factors directly affects long-term profitability. Many managers, management collegial bodies of organizations and enterprises come to the conclusion that environmental, social and managerial factors should determine their strategy.

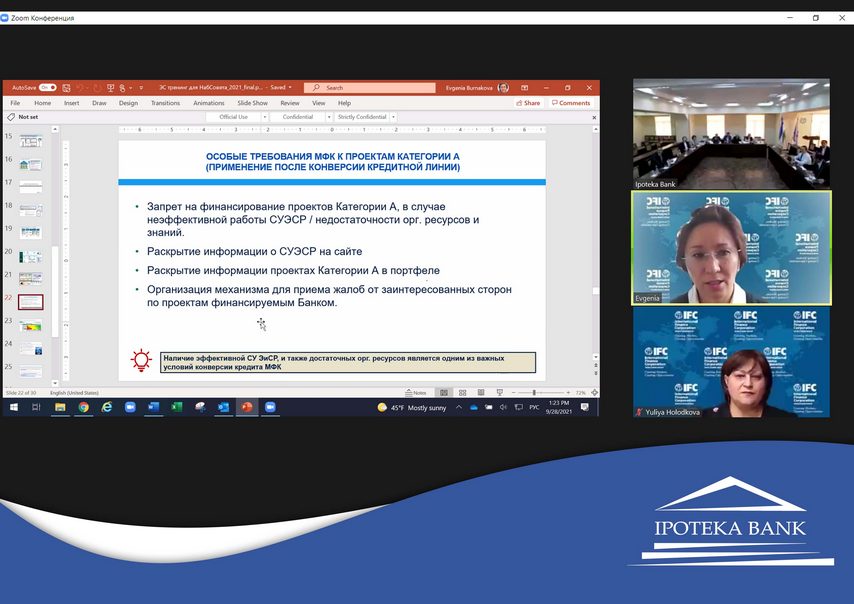

In this regard, the bank's transformation partner - the International Finance Corporation (IFC), organized a webinar for the Bank's Supervisory Board (SB) at the meeting of the SB. The main goal of the webinar was to increase and strengthen the role of the SB in the management of environmental and social risks. During the webinar, IFC consultants and experts provided recommendations for improving the work and considered the priority tasks and functions of the SB in the direction of environmental and social risk management.

In addition, during the meeting it was noted that this area is considered to be relatively new in the banking system of the Republic of Uzbekistan and JSCMB “Ipoteka-Bank” is one of the first banks in the Republic, which ensures the functioning of the Environmental and social risk management system in the bank in accordance with the requirements and standards of international organizations such as IFC and EBRD. During the webinar, further steps and measures that should be taken to improve efficiency in managing environmental and social risks in the bank were productively discussed by the participants.